Distribution Reinvestment Plan (DRIP)

Put more of your distributions to work with DRIP.

What is the Distribution Reinvestment Plan (DRIP)?

The HZ Evergreen Fund Distribution Reinvestment Plan (DRIP) lets you automatically reinvest 10%–100% of each quarterly distribution into additional Fund units—keeping more of your capital working toward long-term goals.

Why investors choose DRIP

- Compounding, made simple. Reinvested distributions buy additional units that are eligible for future distributions.

- Stay fully invested. Reduce cash drag and keep dollars aligned with your HZ Evergreen Fund strategy.

- Flexible. Elect 10%, 25%, 50%, 75%, or 100%—and update annually.

How DRIP works

1. Elect annually by September 30. Your election becomes effective January 1 of the following year.

2. Pricing. DRIP-issued units are determined using the Unit Value* as of the prior quarter end. For example, DRIP-issued units in Q2 would be determined based on a Q1 valuation.

3. Crediting. Units are credited as of the first day of the current quarter for the distribution being reinvested. For example, reinvestment of Q1 distributions would be credited in Q2.

Is DRIP a Good Fit for Me?

- You don’t need every dollar of current income.

- You prefer a disciplined, automatic way to build wealth.

- Staying invested aligns with your long-term plan.

Conversely, taking cash distributions may be preferable if you expect near-term liquidity needs, plan to rebalance your portfolio, or have tax considerations that make cash more advantageous this year. (Reinvested distributions are generally taxable in the year earned; please consult your tax advisor.)

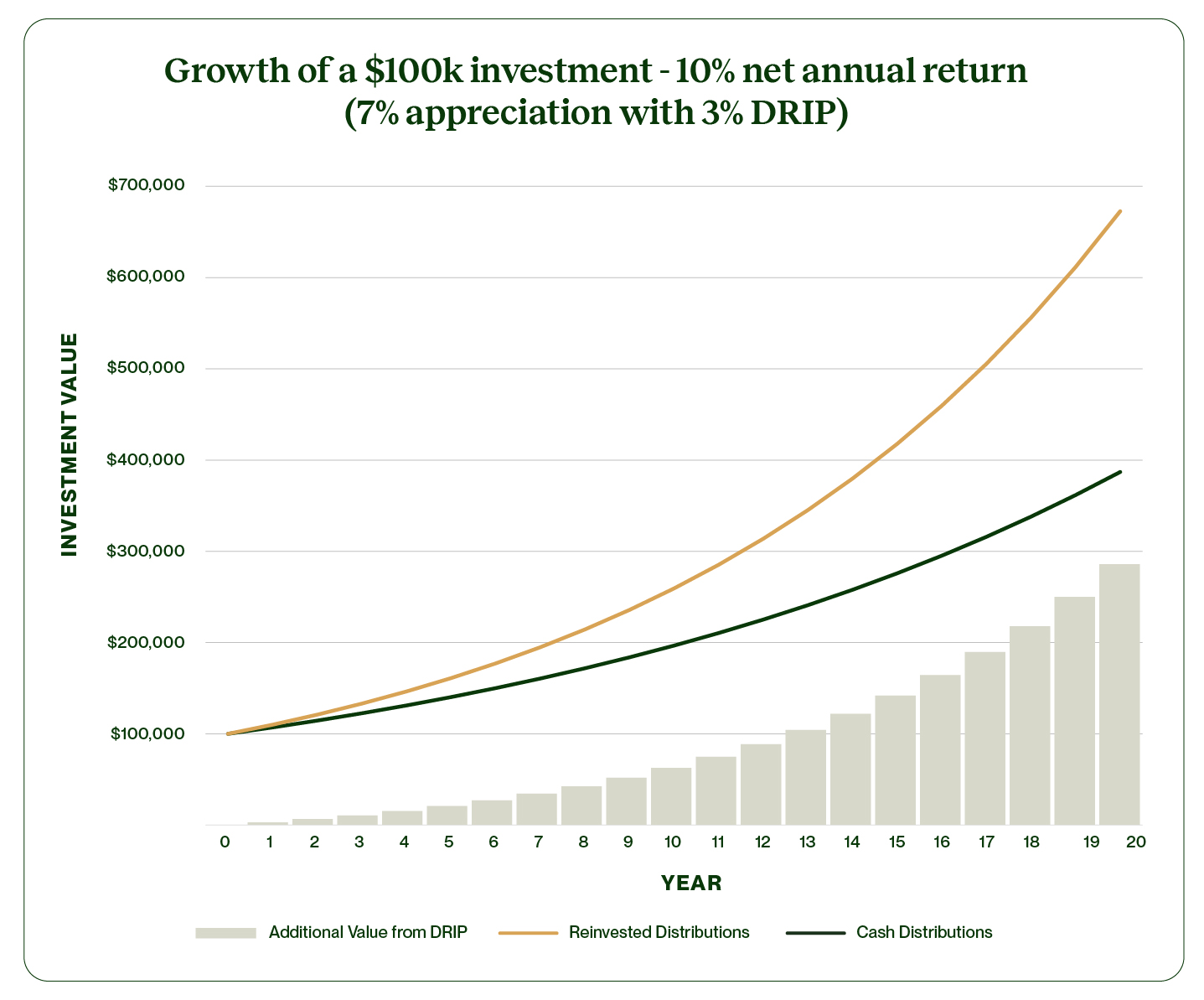

Hypothetical Growth With vs. Without DRIP

The chart below compares account values with reinvested distributions versus taking cash. It highlights how DRIP can amplify growth by keeping more capital invested over time.

Illustrative only and not a guarantee of future results. Assumptions available upon request.

Choose Your DRIP Percentage

Select one option for the coming year: 10% • 25% • 50% • 75% • 100% of each distribution. You can modify your election during the next annual window.

Ready to Take the Next Step?

Connect with our Investor Relations team at 415-561-6800 to discuss what option best fits your goals.

*Members do not direct the time or price of unit issuance. Reinvested proceeds may be used to acquire new investments, Fund redemptions, and for general Fund purposes. DRIP-issued units are subject to the Fund’s standard management fee.

Contact Us to Learn More

Reinvested distributions may be taxable in the year earned. Individuals should consult their own professional advisers before making any investment decision. An investment in real estate involves a high degree of risk and should be considered only by highly sophisticated persons who can bear the economic risk of loss and illiquidity. HZ II, LLC, Hamilton Zanze & Company, and their affiliates (together, “HZ”) make no warranties or representations as to the accuracy or completeness of the information, assumptions, analyses, or conclusions presented herein. Any views expressed herein are subject to change without notice due to market conditions and other variables. In considering any performance data contained herein, past, or targeted performance is not indicative of future results, and there can be no assurance of future performance. The information presented herein is for informational purposes, and may not be considered an offer, or solicitation of an offer, to invest in or to buy or sell any interest or shares or to participate in any investment strategy. Any such offer will be made exclusively by a private placement memorandum (“PPM”) to be provided to interested persons. Any investment should be based on a careful review of the PPM and related documents. All statements herein are qualified in their entirety by reference to the PPM. To the extent that the information presented herein contradicts the PPM, the PPM will govern.