The HZ Evergreen Fund

Our flagship multifamily investment vehicle providing greater diversification, stable income, and tax protection.

What is the HZ Evergreen Fund?

Our proven investment strategy. Same institutional-quality assets. Greater diversification.

Launched in 2024, the HZ Evergreen Fund is Hamilton Zanze’s long-term, diversified real estate investment vehicle. The Fund pools institutional-quality multifamily assets into a large, actively managed portfolio across growth markets nationwide. Unlike traditional 1031 exchanges, the HZ Evergreen Fund simplifies ownership by converting property interests into Fund shares—delivering liquidity, portfolio diversification, and tax advantages in one structure.

These advantages position the HZ Evergreen Fund as a solution for both near- and long-term investment goals.

Benefits of the

HZ Evergreen Fund

Increased diversification

Lower your risk profile with 50 targeted multifamily properties across our highly curated, national portfolio.

Predictable income

Receive predictable and durable income through tax-efficient distributions.

Ability to redeem twice per year

Processed within an estimated 60-day window and redeemed1 at the net asset value2 (NAV) price, allowing you to take advantage of upside growth.

Consolidated tax reporting

Receive one K-1 for all the investments held within the Fund.

Easier estate planning

HZ Evergreen Fund shares can easily be passed down and divided amongst your heirs as part of your estate plan.

Lifetime tax protection

The Fund will protect your tax basis during your lifetime, subject to certain restrictions.3

By the Numbers

Target HZ Evergreen Fund size and scale over the coming years.4

How Does the HZ Evergreen Fund Work?

Discover how the HZ Evergreen Fund transforms your investment into Fund shares, offering improved liquidity and easier estate planning.

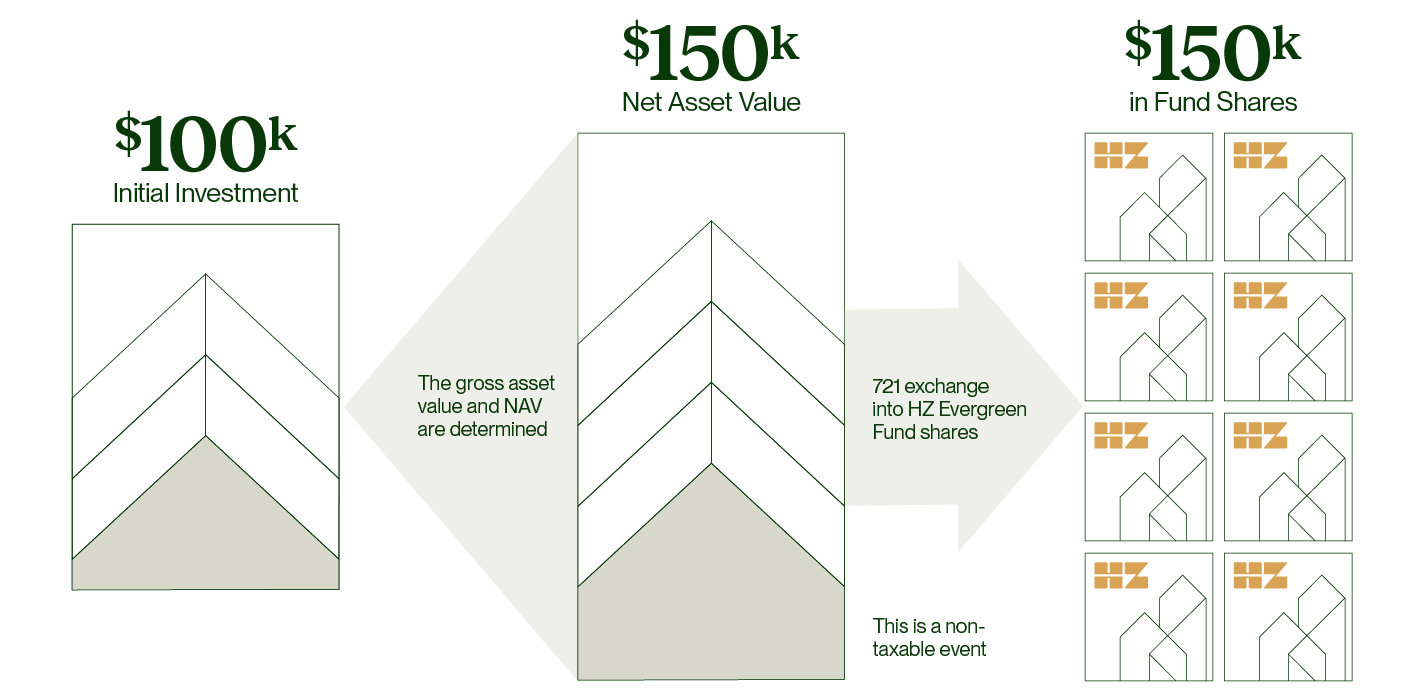

Property–To–Fund Conversion Process

1. It starts with your original investment in a single property or entity.

2. Two independent appraisals are used to determine the gross asset value. Then, the net asset value (NAV) will be calculated by HZ and reviewed by a third-party who will provide a fairness opinion.

3. Using the NAV, which includes any appreciation, the initial investment is converted through a non-taxable 721 exchange5 into shares in the HZ Evergreen Fund.

4. From there, the Fund is expected to deliver more stable distributions backed by a growing, well diversified portfolio.

For illustration purposes only. Actual values may vary.

How Do I Invest in the HZ Evergreen Fund?

Hamilton Zanze offers multiple pathways for investors to invest in the HZ Evergreen Fund, designed to provide flexibility based on your current holdings and investment goals.

1. HZ Property Contribution

Select HZ properties are contributed to the Fund on behalf of existing investors. The properties targeted for contribution to the Fund are part of a select group of HZ-sponsored apartment communities identified from our existing portfolio.

2. 1031 Exchange

Investors can complete a 1031 Exchange to defer capital gains taxes by reinvesting in a Hamilton Zanze property. After two tax periods, the property may be contributed to the HZ Evergreen Fund, creating a pathway into the Fund while supporting long-term diversification and tax advantages.

Learn More About 1031 Exchanges

3. 721 Exchange

Through a 721 Exchange, property owners can contribute approved investment properties in exchange for shares of the HZ Evergreen Fund. This approach allows investors to defer capital gains taxes while transitioning from active property management to passive income and diversification—without the complexities of replacing or refinancing existing property debt.

Learn More About 721 Exchanges

Understanding the Structure and Benefits of the HZ Evergreen Fund

How the HZ Evergreen Fund Compares to Current, Single-Asset Investments

| Features | TIC | DST | Partnership | HZ Evergreen Fund |

| Property decision making | 100% | Trust Manager | 55% | Fund-Managed |

| Voting rights | 100% | 55% | Fund-Managed | |

| Pass-through losses (depreciation) | ✓ | ✓ | ✓ | ✓ |

| Divisibility/Estate planning | ✓ | ✓ | ✓ | |

| Liquidity | 15-30 day ROFR | ✓ | ||

| Passive 1031 exchange experience | ✓ | |||

| Greater real estate diversification | ✓ | |||

| Consolidated tax reporting | ✓ | |||

| More consistent cash flow | ✓ | |||

| Quarterly NAV reporting | ✓ | |||

| Access to more efficient and accretive debt | ✓ | |||

| Ability to reinvest distributions (DRIP) | ✓ | |||

| Access appreciation without a capital event | ✓ | |||

| Cashflow uninterrupted upon exchange | ✓ |

HZ Evergreen Fund Frequently Asked Questions

The Fund is structured to deliver predictable and durable income through tax-efficient distributions.

At this time, the HZ Evergreen Fund does not take cash investments; however, interested investors can speak with our Investor Relations team about our current cash and DST/1031 exchange offerings that may be contributed to the Fund within two tax periods.

DSTs provides access to professionally managed, institutional-quality real estate with tax-deferral, passive income, and diversification—often without the day-to-day responsibilities of direct ownership. DSTs are 1031 exchange eligible, which means if you’re selling a property and want to defer capital gains taxes, you can exchange in and out of a DST.

After two tax periods, Hamilton Zanze may offer investors the option to contribute their interest in the property to the HZ Evergreen Fund through a non-taxable Internal Revenue Code Section 721 exchange. Investors will have the opportunity to convert their Class A shares into shares of the Fund.

Net Asset Value is the net value of an investment fund’s assets less its liabilities, divided by the number of shares outstanding. Using the NAV, along with any appreciation, your initial investment is converted through a non-taxable 721 exchange into shares of the HZ Evergreen Fund. The NAV will be calculated by HZ and reviewed by a third-party who will provide a fairness opinion.

In its initial phase, the Fund will be comprised of approximately 50+ apartment communities across 13 U.S. metros from our existing portfolio.

Yes. The Fund features twice-yearly redemption windows with an estimated 30-day processing time. In contrast, investors in a partnership have a 30-day right of first refusal followed by a 45- to 60-day processing time with no guarantee of liquidity. Redemptions are done at the net asset value price instead of the original par value that is typical in our current structure.

The Fund offers several tax-related advantages. Investors receive tax-efficient distributions designed to deliver predictable and durable income. Additionally, the Fund will protect your tax basis during your lifetime. You’ll benefit from easier estate planning, as Evergreen Fund shares can be passed down and divided amongst your heirs, and consolidated tax reporting with a single K-1 for all investments held within the Fund.

Yes. The HZ Evergreen Fund Distribution Reinvestment Plan (DRIP) lets you automatically reinvest 10%–100% of each quarterly distribution into additional Fund units—keeping more of your capital working toward long-term goals.

Get in Touch

Contact us to explore how the HZ Evergreen Fund works with your portfolio.

*The HZ Evergreen Fund is designed to provide certain tax protections to investors, which the HZ Evergreen Fund intends to memorialize in an individual tax protection letter (“TPL”) issued to each investor who makes an in-kind contribution of property to the HZ Evergreen Fund in an exchange that is intended to be tax-deferred for U.S. Federal income tax purposes. In the TPL, HZ Perpetual Income Fund Holdings, LLC, a Delaware limited liability company (the “Manager”) intends to commit to use reasonable efforts to cause the HZ Evergreen Fund to dispose of an investor’s contributed property(ies) in a tax-efficient manner until such time as a life event may occur that permits such investor to claim a step-up in basis, there is a change in tax law restricting the ability to claim basis step-ups or engage in further tax-deferred exchanges, or other limited scenarios occur that appropriately terminate tax protection. The details of each investor’s tax protection will be documented in the investor’s specific TPL.

1Redemptions scheduled for June 30 and December 31, and subject to restrictions including, without limitation, notice periods, a lockup time frame, discounts (depending on type/character of unit redeemed), loss of tax protection, and certain manager discretion, in each case as set forth in the Fund’s governing documentation.

2Net Asset Value is the net value of an investment fund’s assets less its liabilities.

3Subject to restrictions detailed in the tax protection letter and governing documents.

4As of Q4 2025.

5Structured to be a non-taxable event pursuant to Section 721 of the Internal Revenue Code.

The information presented herein is presented for convenience without any representation or warranty of any kind whatsoever. Individuals should consult their own professional advisers before making any investment decision. An investment in real estate involves a high degree of risk and should be considered only by highly sophisticated persons who can bear the economic risk of loss and illiquidity. HZ II, LLC, Hamilton Zanze & Company, and their affiliates (together, “HZ”) makes no warranties or representations as to the accuracy or completeness of the information, assumptions, analyses, or conclusions presented herein. Any views expressed herein are subject to change without notice due to market conditions and other variables. In considering performance data contained herein, if any, past, or targeted performance is not indicative of future results, and there can be no assurance of future performance. The information presented herein is for informational purposes, and may not be considered an offer, solicitation of an offer, general solicitation, or solicitation of any kind to invest in or to buy or sell any interest or shares or to participate in any investment strategy. Any such offer will be made exclusively by a private placement memorandum (“PPM”) to be provided to persons eligible therefor pursuant to specific federal and state securities laws, rules, and regulations. Any investment should be based on a careful review of, without limitation, the property itself, prevailing contemporaneous real estate and debt markets, the PPM, the metropolitan statistical area at issue, and related governing and investment documentation. All statements herein are qualified in their entirety by reference to the PPM together with any and all governing documentation. To the extent that the information presented herein contradicts the PPM, the PPM shall govern.