High Demand for Renting as Homeownership Costs Increase

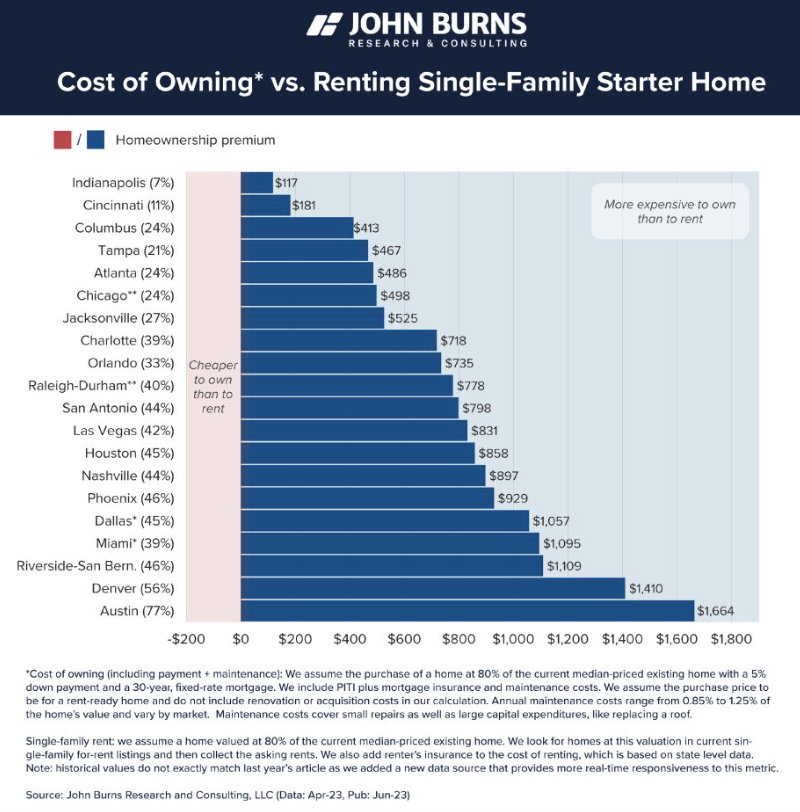

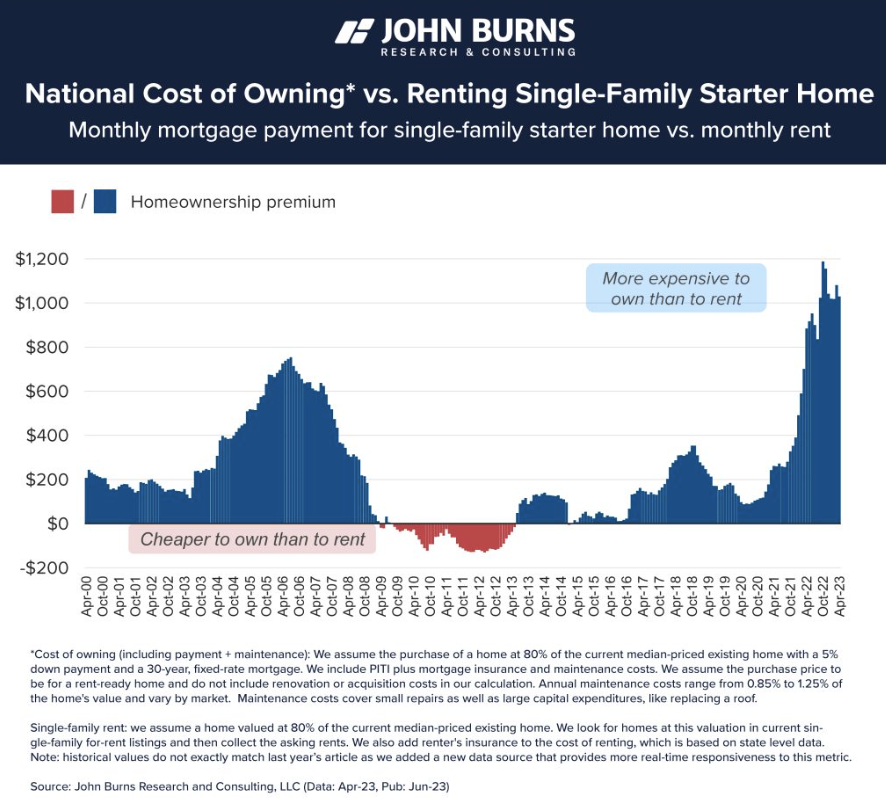

Burns Research & Consulting previously reported on the shift in demand from homeowning to renting. Now, almost a year later, there continues to be a growing demand for rental homes, while the demand for home ownership has steadily declined. The monthly premium to own is now marked at $1,030 per month, compared to $884 per month at this time last year. This metric has decreased from a $1,188 peak in October 2022, but stays much higher than usual.

Home renters have remained in place and an increasing number of buyers have receded as the cost to purchase a home has become unaffordable for many.

It is important to note that the premium varies per market and is lower in the Midwest region. However, as for some of HZ’s markets, there has been a steady, increasing demand for rental housing. The tables within depict comparative data for homeownership vs. renting from three of HZ’s current markets following the methodology of Burns Research & Consulting’s charts: Nashville, Denver, and Charlotte. We adjusted the analysis to compare the cost of owning vs. renting multi-family apartments.

Due to persistent demand for rental housing, to which the substantial homeownership premium contributes, multi-family investing remains an attractive option. Hamilton Zanze continues to capitalize on this real estate cycle to expand our company footprint.