Multifamily Real Estate: A Resilient Asset Class in a Changing Economic Landscape

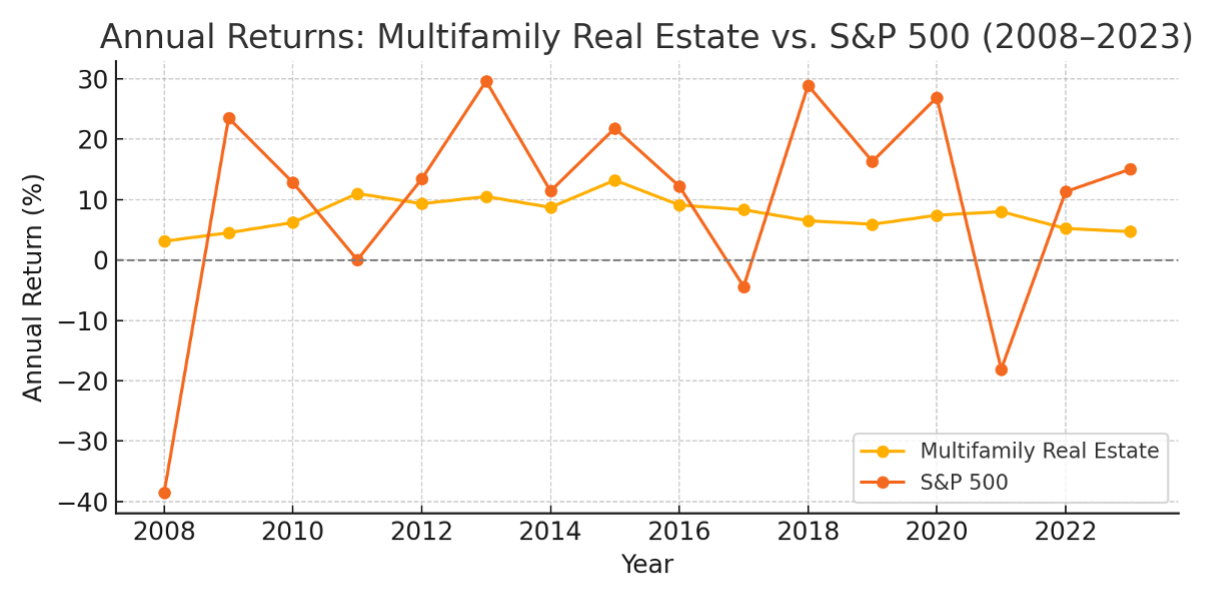

Tariffs, inflation, and equity market volatility have reintroduced a heightened level of uncertainty to the global economy. With traditional safe havens such as bonds also facing challenges—particularly in a rising interest rate environment—investors and advisors are increasingly evaluating the role of real assets in portfolio diversification.

Multifamily real estate, as part of the broader real asset category, continues to attract attention for its income-generating potential and its foundation in tangible, demand-driven fundamentals. This brief outlines macroeconomic considerations that inform multifamily’s positioning and explores how the asset class fits within long-term investment strategies.

Demand Characteristics and Market Behavior

Housing remains an essential expenditure, and rental housing, in particular, has historically demonstrated resilience across economic cycles. While renters may shift preferences in unit size or location during downturns, overall demand for multifamily housing tends to remain intact.

Several long-term trends continue to support the sector:

- Structural limitations in housing supply

- Elevated mortgage rates discouraging homeownership

- Population migration patterns and increased preference for rental flexibility

These dynamics contribute to relatively predictable cash flows for multifamily assets, especially in markets with constrained supply and sustained population growth.

Sources: NCREIF, NAREIT, Yahoo Finance, internal estimates.

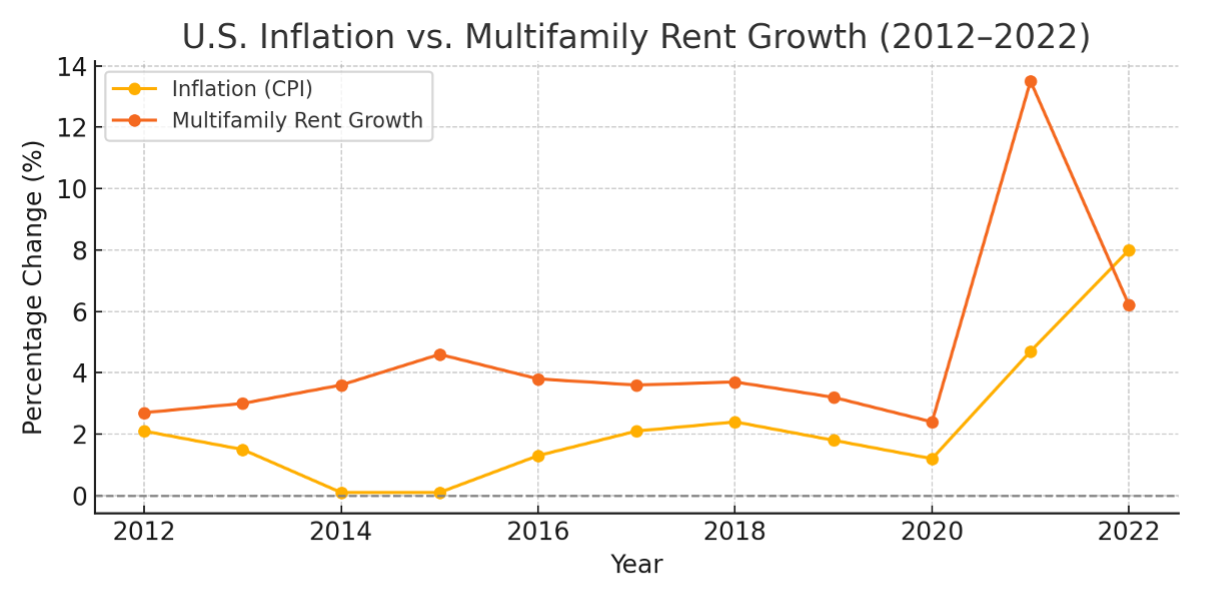

Inflation and the Role of Real Assets

In an inflationary environment, real assets may serve as a partial hedge due to their intrinsic value and replacement cost. Multifamily properties, in particular, have attributes that help mitigate inflation’s impact:

- Short-term leases that allow for more frequent rent adjustments (market conditions permitting)

- The ability to enhance value through physical improvements and repositioning

- Tax benefits such as depreciation that can reduce taxable income

Both 1031 exchange and direct cash investors may benefit from these attributes. While 1031 exchanges allow for capital gains deferral, even non-exchange participants often experience partial tax deferral on distributions due to depreciation and cost segregation.

That said, rent growth is not guaranteed and may be constrained by affordability factors or local regulations. As such, multifamily’s inflation protection should be viewed in the context of broader asset management decisions.

Sources: U.S. Bureau of Labor Statistics; Yardi Matrix; RealPage Analytics.

Risk Considerations and Operational Drivers

Despite its advantages, multifamily real estate is not immune to economic or operational risk. The performance of any asset depends on a range of factors, including:

- Market selection and acquisition timing

- Operational efficiency and expense control

- Execution of capital expenditure programs aligned with resident needs and market trends

Periods of high inflation and interest rate volatility can compress margins, especially in markets with limited rent growth potential. Regulatory changes and shifts in local demand can also introduce downside risks. Active asset management remains critical to achieving investment objectives.

Multifamily Within the Portfolio Context

Multifamily real estate can play a complementary role in a well-constructed portfolio, offering a mix of current income, tax efficiency, and diversification from traditional equities and fixed income. While it is not a replacement for other core holdings, it can provide a differentiated risk-return profile and serve as a tool for capital preservation, particularly in the context of long-term planning.

Additionally, the structure of multifamily investments may appeal to those seeking a reinvestment option for existing real estate proceeds, such as through a 1031 exchange or other strategic planning vehicle.

Conclusion

Amid macroeconomic changes—including trade policy shifts, inflationary pressures, and capital market volatility—investors are reconsidering how they allocate capital across asset classes. Multifamily real estate offers a combination of physical durability, income potential, and tax-advantaged structures that may support portfolio resilience.

As with any investment, outcomes will depend on the specifics of each opportunity, including location, timing, and execution. For those willing to take a long-term view and apply disciplined underwriting, multifamily can serve as a meaningful component in a diversified investment strategy.