A 1031 exchange with an established real estate sponsor like HZ can provide tax benefits, portfolio diversification, appreciation, and passive income.

ReadToday, investors are searching for yield in historically conservative instruments and finding options that were unavailable until recently. Current rates for short-duration positions – including Treasury Bills (T-bills), CDs and high-yield savings accounts – are higher than they have been in years. However, by taking a closer look at the numbers, a strong case can be made that multifamily real estate is a smarter choice for investors given its after-tax benefits.

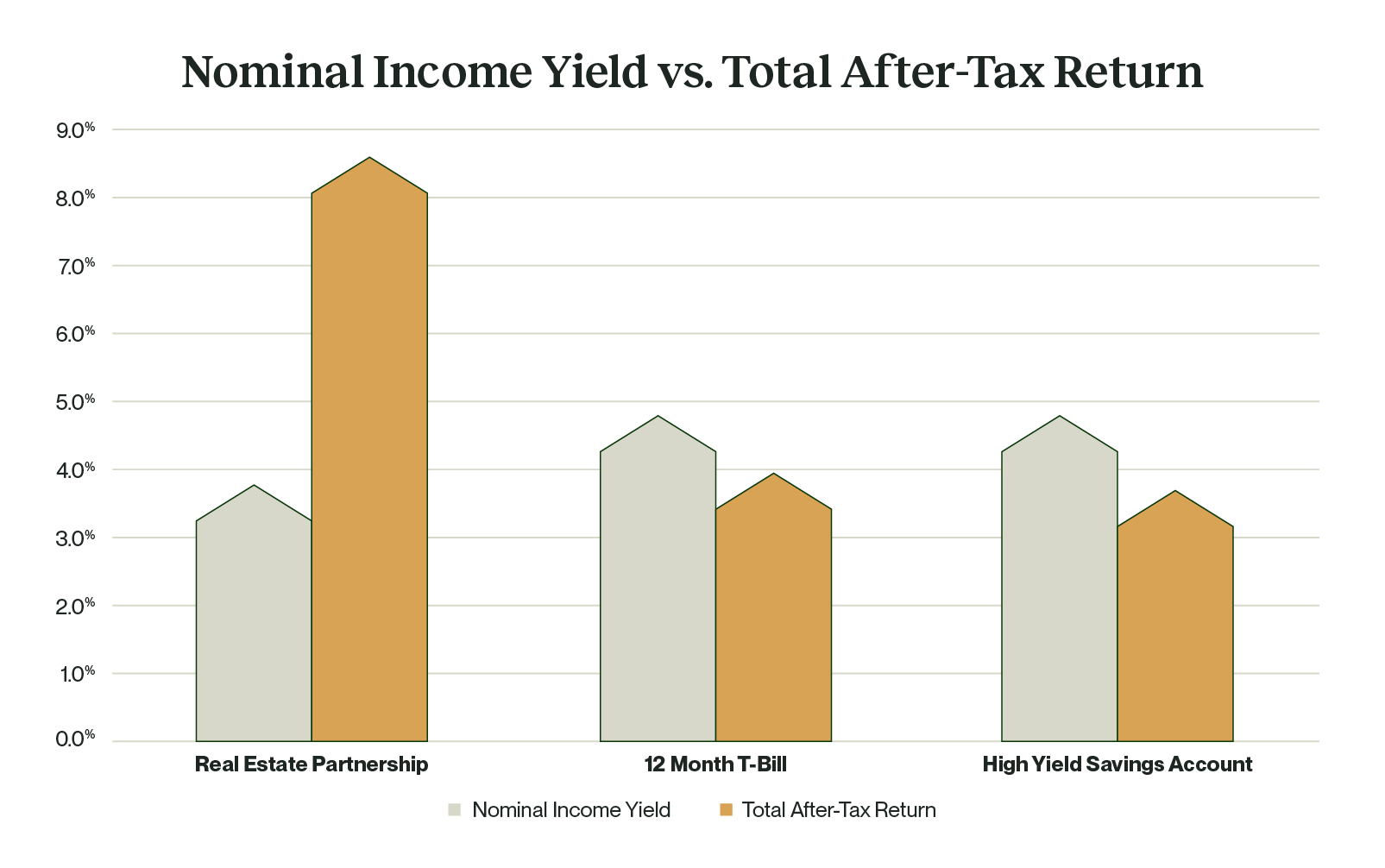

Looking solely at rates, investors may ask why they should accept the risk and illiquidity of a private equity realty investment for pre-tax returns lower than other investment options. That makes sense – if you’re simply comparing a 4.5% yield on a 12-month T-bill to a 3.5% distribution for a real estate partnership. A quick tax analysis, however, shows this conclusion misses the bigger picture.

The effects of income taxes on total returns are significant. To illustrate this point, let’s compare the after-tax yields from T-bills, CDs and deposits (which are tax-exposed) to those from multifamily property (which benefit from sheltering and other long-term tax benefits).

An Investor making $200,000 annually sustains a federal income tax rate of approximately 18%, along with any state taxes (6% in California). A $100,000 CD investment paying 4.5% will net only 3.4% (or less) after taxes. The tax hit will be more severe for those in higher income brackets.

By contrast, distributions from multifamily investments are more tax-efficient, given the benefits of depreciation and treatment of income as return of capital. Moreover, the 1031 exchange allows investors to defer capital gains taxes when a property is sold, supporting the continued creation of long-term tax-efficient wealth

When it comes to risk management, T-bills are considered virtually risk-free. In addition, high-yield savings deposits of less than $250,000 at FDIC-insured banks are backed by the government. However, until recently, deposit rates at major banks have been extremely low, especially at the largest institutions. Despite the current rate surge, investors are now looking to regional and online banks for even higher yields. By comparison, asset-backed investing, specifically in multifamily property, has proven to be a reliable hedge against both rate and market volatility, without any limitations on investment.

Short-term positions like T-bills and deposit instruments do not typically create gains for investors. The value of real estate investments, however, have the potential to increase over time.

When it comes to multifamily specifically, we see strong appreciation upside, as the ongoing demand for apartments far exceeds anticipated deliveries, with an estimated shortfall of four million units over the last 10 years. This is unlikely to change any time soon, with new apartment construction impeded by inflated building costs, high interest rates, and stricter constructing lending standards. Furthermore, the high cost of home purchasing today leaves renting as the best option for many would-be buyers. Not to mention “renters by choice” like Baby Boomers, who are increasingly opting to downsize into rental housing.

Today’s bond markets show an Inverted Yield Curve, in which short-term positions earn higher returns for brief durations, while the earnings on longer-term investments are lower but last longer.

For example, investors may make 4.5% on a one-year instrument, while earning 3.8% on a 10-year treasury bond. Nonetheless, pension funds, endowments, sovereign funds and money managers are still actively buying the 10-year bond, foreseeing that short-term yields will decline when the Fed reverses monetary policy. In this view, more return will be realized with longer duration and illiquidity despite the initially lower coupon. More to the point, there is still active traffic in the longest terms – 10 and 30 years – as institutional investors anticipate lower returns ahead.

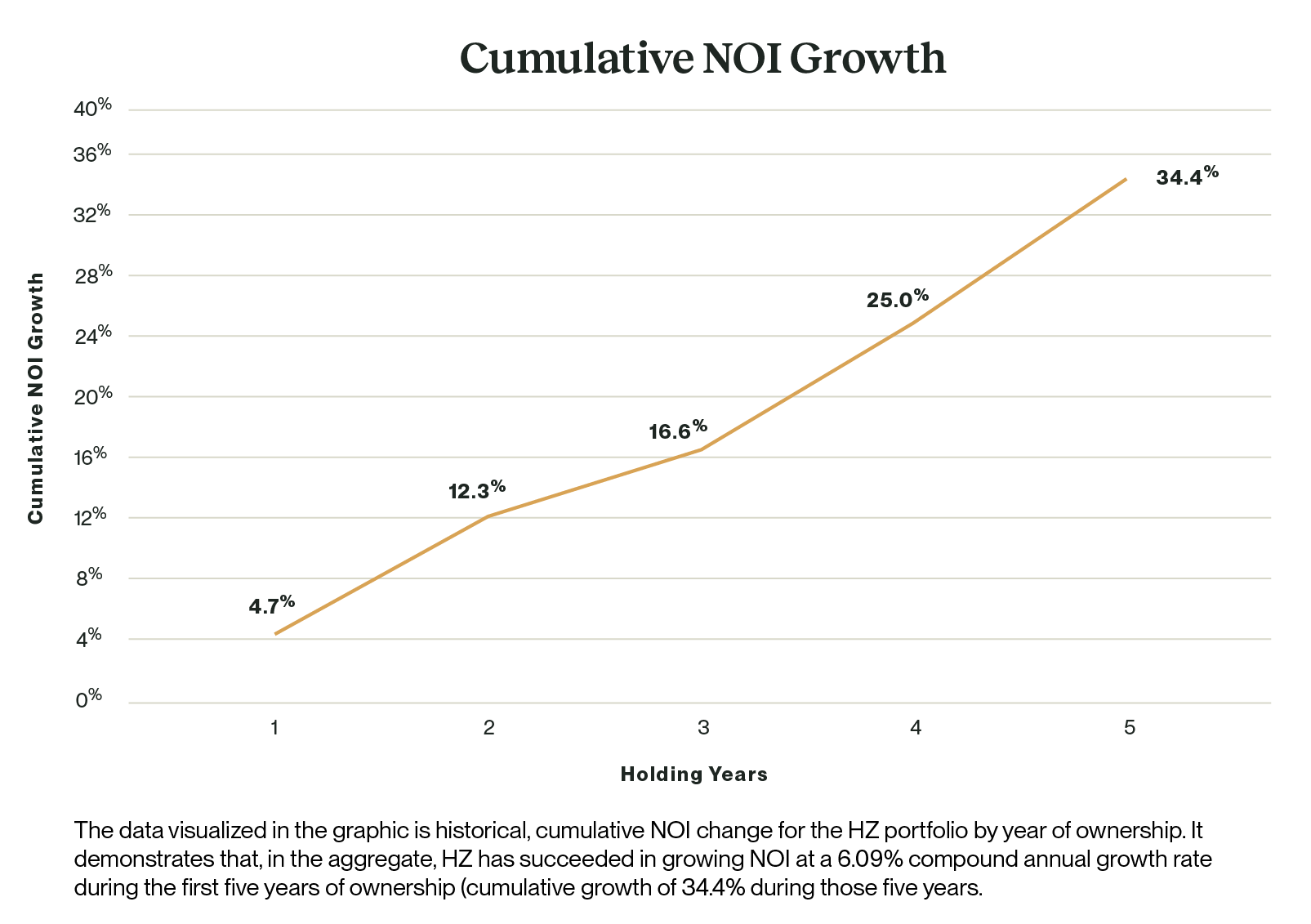

With real estate, yield expectations are flipped. Investment performance tends to improve over time, with the greatest benefits realized in the long term. Investors may initially earn slightly less than they would with short-term instruments, but they anticipate higher returns over time.

While current short-term options are attractive before taxes, the investment of many trillions of dollars in the bond market demonstrates a conviction that today’s short-term rates will prove ephemeral. Based on our experience – and the 40-year trend of central bank monetary policy – we anticipate we will again move toward both lower rates and lower inflation.

When buying a treasury instrument or CD, investors accept finite-term illiquidity in exchange for a specific return upon maturity. If there is an unanticipated need for liquidity, the investor typically pays a penalty.

Liquidity is also a consideration for private realty investments, albeit with the potential for a greater “illiquidity premium” (reward). According to a recent Franklin Templeton white paper [1], “While the magnitude of the illiquidity premium will vary over time, depending upon the market environment and the fund, the data show that private equity, private credit and private real estate have historically delivered a substantial illiquidity premium relative to their public market equivalents.”

Another important consideration is the ability to control the performance of the investment. Investors have no control over interest rates, public markets or activity in the macro environment. Positions in T-bills or CDs are finite, regardless of market changes. Control is relinquished in exchange for a turnkey product with specific duration and yield.

Investing in real estate is different, as property owners and managers can make strategic decisions during the hold period to impact the asset’s performance, thereby increasing net operating income (NOI) and enhancing investment value.

Finally, investing in multifamily property can provide a valuable hedge against inflation. Given the typical annual reset of rents, asset managers have the flexibility to quickly adjust pricing to meet demand and to offset rising operational costs. Historically, apartment rents have outpaced inflation, compared with other property types that lack this resetting ability.

In today’s environment, it pays to take a broader view and consider more than face rates of T-bills, CDs and high-yield savings accounts, comparing them to the after-tax returns and long-term earning power offered by investments in multifamily real estate.

[1]The Cost of Being Too Liquid, January 2023